The Initial Hesitation – Cost vs. Value

Hey Kingston entrepreneurs, we know that familiar tug of war happening in your head. You’ve got your eyes on that business coaching opportunity that promises to take your venture to new heights. It’s like a golden ticket to success, but then reality hits: the investment required gives you pause.

But let’s talk real for a moment.

The hesitation around the cost of business coaching is a universal concern. In Kingston and Surrey, where every penny counts, it’s not just a financial decision; it’s a strategic one. The balance between cost and value becomes the key player in this internal debate.

So, what’s the catch? Investing in your business is like planting seeds. You water them, nurture them, and eventually, you reap the benefits in the form of a flourishing garden. Business coaching is no different – it’s the expert gardener guiding you, ensuring those seeds blossom into success.

Here are a few things to consider:

- Long-Term Gain vs. Short-Term Cost: Yes, business coaching comes with an upfront cost, but envision the long-term gain. It’s not just about the immediate expense; it’s an investment in the sustainable growth of your business.

- Your Time is Money: Think about the hours you spend navigating challenges, experimenting with strategies, or trying to figure out the next move. A business coach condenses that time, providing you with a roadmap to success and potentially saving you countless hours and resources.

- Strategic Decision-Making: Business coaching isn’t just about the dollars you spend; it’s about strategic decision-making. It’s about having an experienced guide helping you make informed choices that align with your business goals.

- Stagnation vs. Growth: Consider the cost of staying where you are versus the cost of growth. Stagnation can be more expensive in the long run, especially when opportunities are missed, and competitors surge ahead.

Remember, it’s not just about the expense; it’s about the value gained. In the following sections, we’ll explore how the potential tax deductibility of business coaching might just be the financial breather you’re looking for. So, Kingston entrepreneurs, let’s unpack the numbers and discover if the path to business success is more affordable than you thought.

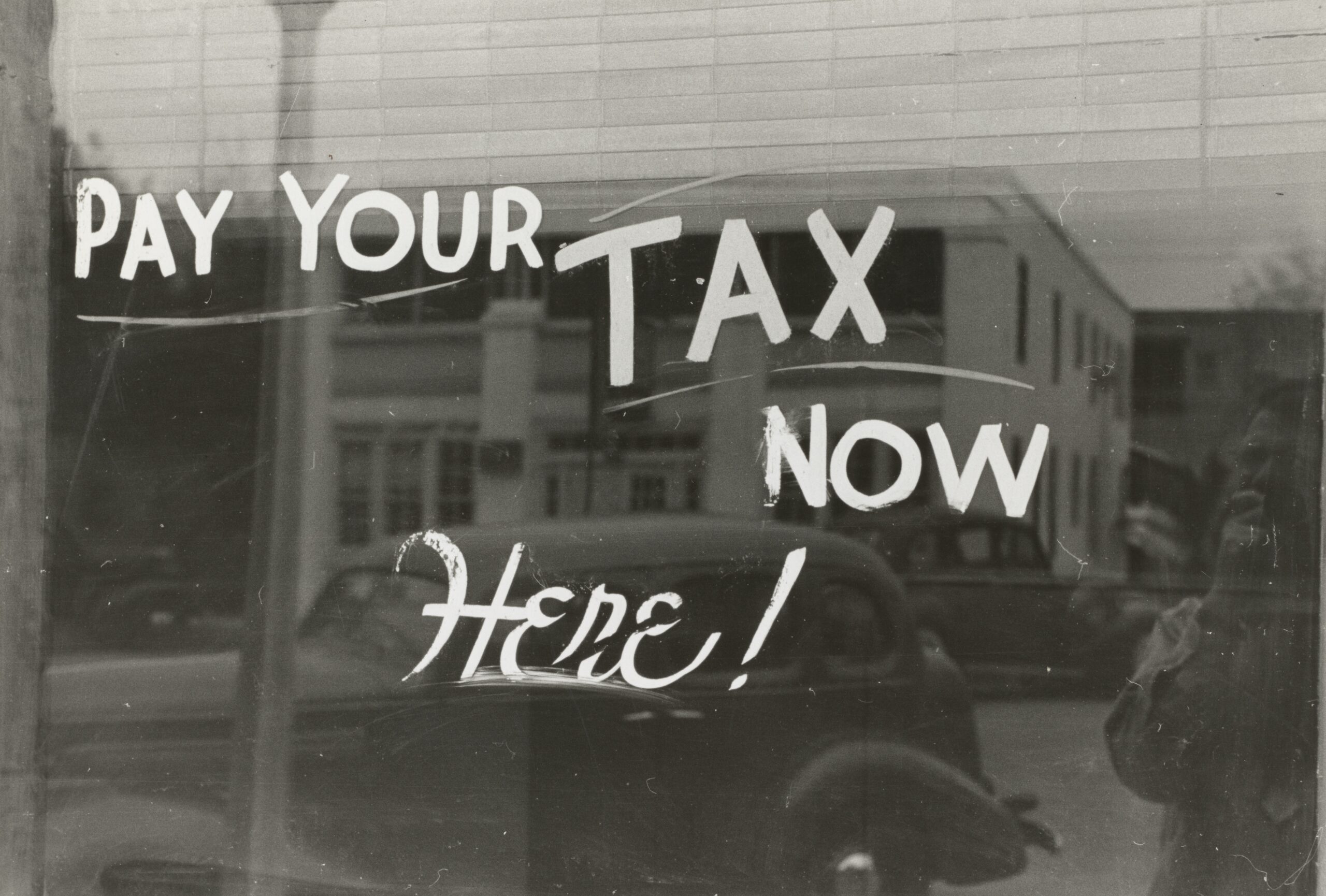

The Tax Deduction Cliff Notes

Now that we’ve eased into the idea of business coaching as a valuable investment, let’s talk about the potential silver lining – tax deductions. It’s like finding an unexpected discount on something you were already planning to buy. Who doesn’t love a good deal, especially when it comes to investing in your business?

So, let’s break down the tax deduction cliff notes:

- HMRC’s Recognition: The first nugget of good news – the HMRC (Her Majesty’s Revenue and Customs) recognizes the importance of skill development for business owners. They understand that a well-equipped business owner is an asset not only to themselves but to the economy as a whole.

- Eligibility Criteria: Not all expenses are created equal in the eyes of the HMRC. Business coaching expenses must meet certain criteria to be eligible for tax deductions. Understanding these criteria is like having the key to the tax deduction kingdom.

- Business Benefit: The HMRC wants to see a clear benefit to your business from the coaching expenses. This means that the coaching should directly contribute to the improvement or growth of your business. If it’s an investment in your skills that will, in turn, benefit your business, you might be onto something.

- Documentation Matters: Like any good transaction, paperwork is essential. Keeping meticulous records of your coaching expenses, including receipts and invoices, is crucial when it comes time to present your case to the taxman.

- Business Structure Matters: The tax implications can vary based on your business structure – whether you’re a sole trader, part of a partnership, or running a limited company. Knowing the tax landscape for your specific structure is key to maximizing potential deductions.

Why does this matter?

Understanding the HMRC’s stance on business coaching expenses sets the stage for a potential win-win situation. It aligns with the idea that investing in yourself is an investment in your business, and the government recognizes and supports this perspective.

In the next section, we’ll delve deeper into how the HMRC views business coaching and the specific criteria that could turn your coaching expenses into a deductible business cost. So, Kingston entrepreneurs, let’s get ready to decode the tax game and uncover potential savings for your business coaching journey.

The HMRC’s Lens on Business Coaching

Picture this: you’re wearing HMRC glasses, and suddenly, the landscape of business coaching becomes clearer. The HMRC has a specific lens through which they view business coaching expenses, and understanding this perspective can be a game-changer….